@nattydaddy604 said:

@mattbbpl said:

@n64dd: "Don't see anything wrong with that."

Do you approve of the idiocy or the shameless shilling?

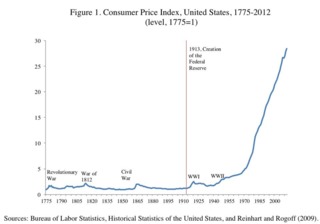

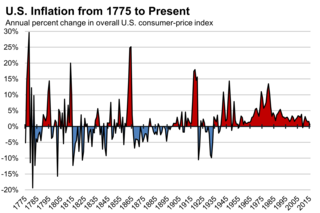

uhh, you do realize every fiat system with no backing has failed? Every single one? Including those that have a monetary backing and STILL participate in deficit spending? The reason why cost of living is increasing is because the Federal Reserve keeps printing money to artificially keep interest rates low, pushing inflation up too? The federal Reserve is a PRIVATE institution with shareholders? Profiting off the Americans and destroying the economy and their purchasing power?

So every modern country's fiat system has failed? Uh, yeah, you're going to have to do some real rhetorical gymnastics to prove that one. Not to mention that countries that converted from the gold standard during the great depression recovered from it faster than those that didn't. If that's what failure looks like, then sign me up.

And the fed doesn't print money to keep interest rates low. It doesn't print money at all, the Treasury Department does. What it does is essentially buy loans from the banks so that they have cash on hand instead of low-interest investments, and thus are more willing to extend cheap credit. And if this is supposed to drive inflation then why haven't we had yearly inflation rates of 3% since 2011 and haven't gone over 4% since 1990? How come there are more modern economies dealing with deflation than inflation?

@Damedius said:

C)They work for those really in power, enriching them on the backs of the masses. The same policy that has been carried forward for last 40 years without stop, regardless of who controls congress, the senate or the presidency.

Meanwhile you guys cheer lead for your favourite side in a game that doesn't matter.

Which is why not only has the new Fed chairman's policy differed greatly from his predecessor, but his predecessor has criticized both his moves and Trump's statements about policy, right?

You're right that there is a game being played here and that there are people on both sides profiting from it, but you're massively wrong about what the game itself is. If you really want to know why these policies are being pushed, look at who benefits. Businesses are sitting on massive amounts of cash reserves made even more massive by the Trump tax cuts, but they haven't drastically expanded hiring or wages. They've gotten used to easy credit caused by low rates, and as soon as the fed starts ticking rates up they cut forecasts and send the stock market downward. Wall Street traders are making bank speculating on companies with easy access to credit, and therefore highly decreased risk of failure.

On the other side, people like Herman Cain are pushing the gold standard, but why? Well, for one it calcifies the current economic distribution. If we go back to the gold standard then money and thereby wealth is limited by the amount of gold in a given country, making economic mobility harder to achieve. If you believe that people who have money deserve it and people who don't don't, then a gold standard fits in perfectly with this worldview. Second, it would constitute a massive boon to people with investments in gold and gold mining. I wonder if Cain either has interests in gold or is connected with people who do? Hmmm. Thirdly, it would grant vastly more power to countries with large gold reserves and unmined gold. The country with the largest amount of unmined gold is Australia, and the top four countries in terms of gold reserves are the U.S., Italy, France and Germany. Hmmmm. If you want to know the power those gold reserves could play, just look at what happened recently in Venezuela. The government tried to call in its gold reserves that are being held by Britain when the international community refused aid, and Britain refused to comply. If national currencies were based on the gold standard, it would give tremendous power to Western countries to shape the policy decisions of other nations.

So, on one side, you have a bunch of people cynically keeping rates low in order to benefit their big businesses buddies, on the other side you have people pushing for a change of standard in order to increase their own wealth and power, and in the middle there are people interested in crafting nuanced policy that responds to everyone's needs, and you want to say everyone's the same? No, there are very big differences between the ways the two parties approach monetary policy.

Log in to comment