The screenplay for that kind of movie always ratchets up the tension. The besieged citadel fends off assault after assault, but again and again rescue is delayed. And so it has played out in practice. Consumers kept spending as the Internet bubble collapsed; they kept spending despite terrorist attacks. Taking advantage of low interest rates, they refinanced their houses and took the proceeds to the shopping malls.

But predictions of an imminent recovery in business investment keep turning out to be premature. Most businesses are in no hurry to go on another spending spree. And those that might have started to invest again have been deterred by sliding stock prices, widening bond spreads and revelations about corporate scandal.

Will the rescuers arrive in the nick of time? Not necessarily. This movie may not be ''55 Days at Peking'' after all. It may be ''A Bridge Too Far.''

A few months ago the vast majority of business economists mocked concerns about a ''double dip,'' a second leg to the downturn. But there were a few dogged iconoclasts out there, most notably Stephen Roach at Morgan Stanley. As I've repeatedly said in this column, the arguments of the double-dippers made a lot of sense. And their story now looks more plausible than ever.

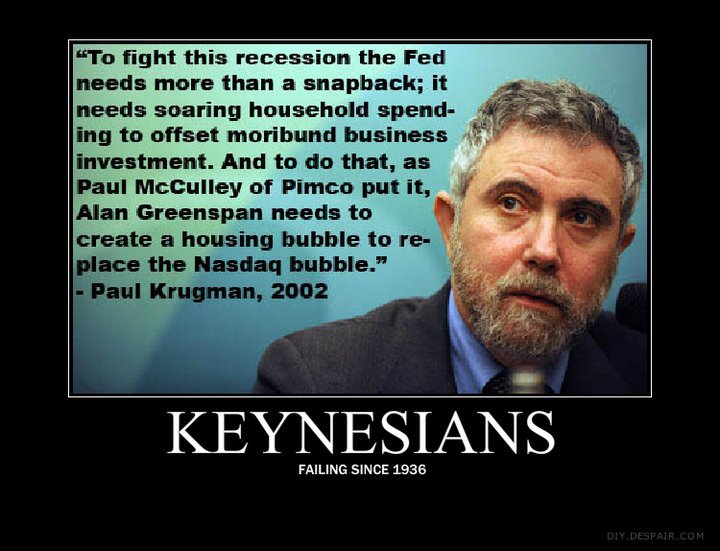

The basic point is that the recession of 2001 wasn't a typical postwar slump, brought on when an inflation-fighting Fed raises interest rates and easily ended by a snapback in housing and consumer spending when the Fed brings rates back down again. This was a prewar-style recession, a morning after brought on by irrational exuberance. To fight this recession the Fed needs more than a snapback; it needs soaring household spending to offset moribund business investment. And to do that, as Paul McCulley of Pimco put it, Alan Greenspan needs to create a housing bubble to replace the Nasdaq bubble.

Judging by Mr. Greenspan's remarkably cheerful recent testimony, he still thinks he can pull that off. But the Fed chairman's crystal ball has been cloudy lately; remember how he urged Congress to cut taxes to head off the risk of excessive budget surpluses? And a sober look at recent data is not encouraging.Paul Krugman

Log in to comment